Welcome ToTride Foreclosure Relief

Welcome to Tride Foreclosure Relief

We understand the emotional distress, financial hardship, and credit devastation that foreclosure brings. That’s why we offer fast, legal, and affordable foreclosure relief services tailored to your unique situation. Whether you need loan modification assistance, a short sale solution, forbearance extensions, investor-backed buyout options, or simply expert guidance on how to avoid foreclosure in your state — Tride is here to help.

Our team specializes in helping homeowners across the country avoid foreclosure legally, without resorting to bankruptcy, while preserving homeownership, credit health, and peace of mind. We also assist with hardship documentation, lender negotiations, relocation planning, and financial recovery coaching.

Why Homeowners Trust Tride

We offer legal alternatives and financial strategies that protect your credit and your dignity — no court filing required.

Every home is different. We assess your unique situation and craft a plan that works for you, not the bank.

Your information is safe. We respect your story and fight for your outcome.

Get help negotiating with lenders to reduce payments or change terms.

We take immediate steps to pause the foreclosure process.

Sell fast before auction — or let us connect you with buyers.

From hardship letters to forbearance setups, we handle it all.

Our Services

Legal Navigation

We help you access non-bankruptcy legal options that keep you protected and empowered.

- Loan Modification Support (including HAMP-style workouts & direct lender negotiations)

- Forbearance Extension Advocacy for grace period extensions

- Deed-in-Lieu Agreements to avoid foreclosure and clear liability

- Short Sale Coordination — avoid auction, forgive debt

- Foreclosure Defense Referrals to licensed attorneys (non-law firm partnerships)

Financial Restructuring

We re-engineer your financial profile to stabilize income, minimize liabilities, and prepare you for long-term recovery.

- Debt-to-Income Assessments & personalized budget coaching

- Hardship Documentation Assistance — build persuasive lender-ready files

- Cash Flow Optimization Plans to preserve your household

- Bridge Loan Matching with trusted investor partners (ideal if you’re close to financial recovery)

- Loss Mitigation Filing Assistance to formally trigger protections

Housing Solutions

When staying in your home isn’t feasible, we help you preserve dignity, equity, and future options.

- Sell-to-Stay Programs — investor leaseback options to remain in your home

- Home Equity Buyback Support if you’ve lost ownership but want a second chance

- Relocation Planning & Exit Strategy Management

- Reverse Mortgage Counseling for elderly clients to unlock home value safely

Mediation & Advocacy

We are your voice when dealing with institutions, helping you cut through red tape and access real help.

- Lender & Servicer Negotiations for fair solutions

- Aid Application Support — help with local or state homeowner relief programs

- Emotional Wellness Coaching — because financial recovery starts with clarity and peace

- Lender & Servicer Negotiations for fair solutions

Other services

Because financial distress often goes beyond missed mortgage payments.

At Tride Foreclosure Relief, we recognize that foreclosure is rarely an isolated crisis. Many of our clients are also victims of fraud, misrepresentation, or predatory business practices that accelerate financial collapse. That’s why we go beyond standard foreclosure help — providing support, referrals, and strategic advice for a wide range of related legal and financial issues.

Bankruptcy Guidance & Alternatives

While our core mission is helping clients avoid bankruptcy, we understand that in some cases, it may become a necessary part of a broader recovery plan. We help you understand the difference between Chapter 7, Chapter 13, and non-bankruptcy options, and connect you with licensed professionals for transparent, ethical advice — with no pressure to file.

We Help With:

- Understanding Chapter 13 repayment structures vs. Chapter 7 liquidation

- Identifying if bankruptcy actually benefits your housing situation

- Exploring foreclosure delay strategies without court filing

- Referrals to trusted bankruptcy attorneys (if needed)

Home Title Fraud & Real Estate Scams

Homeowners are increasingly becoming targets of title theft, deed fraud, and fake foreclosure scams. Fraudsters may forge signatures, manipulate notary records, or illegally transfer title without your consent.

We Help With:

Investigating suspicious title transfers or mortgage reconveyances

- Reversing fraudulent deeds or power-of-attorney misuse

- Filing complaints with county recorders or consumer protection agencies

- Connecting you with real estate attorneys specializing in deed fraud

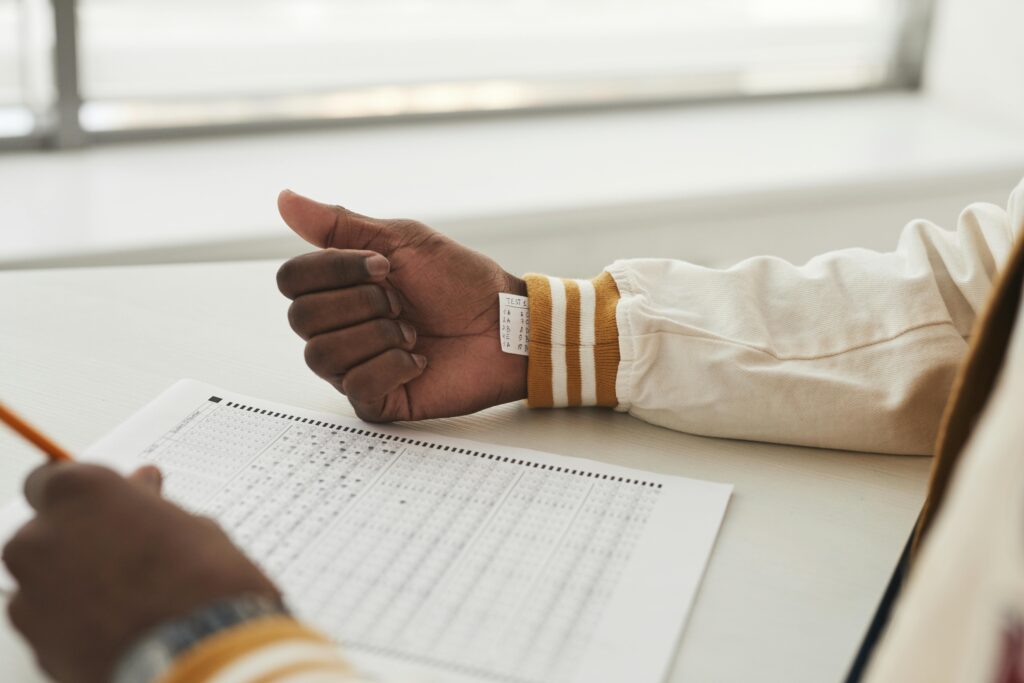

Solar Panel Fraud & Misleading Contracts

Solar installation scams are on the rise. Homeowners are being tricked into signing inflated loan agreements, fake “zero cost” leases, or locked into energy contracts that destroy property value or interfere with refinancing.

We Help With:

- Reviewing solar loan agreements and leases

- Filing complaints for misrepresentation or installation defects

- Resolving PACE loan issues tied to your mortgage

- Helping homeowners seek legal recourse or restitution

Predatory Lending & Loan Modification Abuse

Many lenders and servicers engage in unfair practices that push homeowners deeper into debt — including dual tracking, loan mod bait-and-switch tactics, or excessive fees hidden in escrow adjustments.

We Help With:

- Identifying RESPA and TILA violations

- Challenging improper loan servicing or denial patterns

- Filing CFPB and AG complaints

- Connecting with foreclosure defense experts

Professional Negligence & Legal Malpractice (Referrals)

If an attorney, financial advisor, broker, or notary failed to act in your best interest — or made your situation worse through incompetence or conflict of interest — you may have grounds for a professional malpractice claim.

We Help With:

- Reviewing actions by prior legal or financial representatives

- Assessing negligence or misrepresentation

- Referring to licensed malpractice attorneys in your state

- Documenting breaches of fiduciary duty

Comprehensive Advocacy, Beyond Foreclosure

Tride Foreclosure Relief is not a law firm — but we partner with an ecosystem of professionals who can help you navigate:

- Debt collector harassment (FDCPA violations)

- Credit reporting disputes (FCRA corrections)

- Contract rescission options

- Government relief programs you may qualify for